In the realm of personal finance, deciphering a paycheck stub is a crucial skill that empowers individuals to understand their earnings, deductions, and net pay. Reading a Paycheck Stub Worksheet Answers serves as an indispensable guide, providing a comprehensive overview of the key elements found on a paycheck stub and their implications.

This detailed resource delves into the purpose and structure of a paycheck stub, explaining the significance of each section and the calculations involved in determining gross earnings, deductions, and net pay. It also explores the various types of taxes withheld from a paycheck and how to calculate the amount of taxes owed.

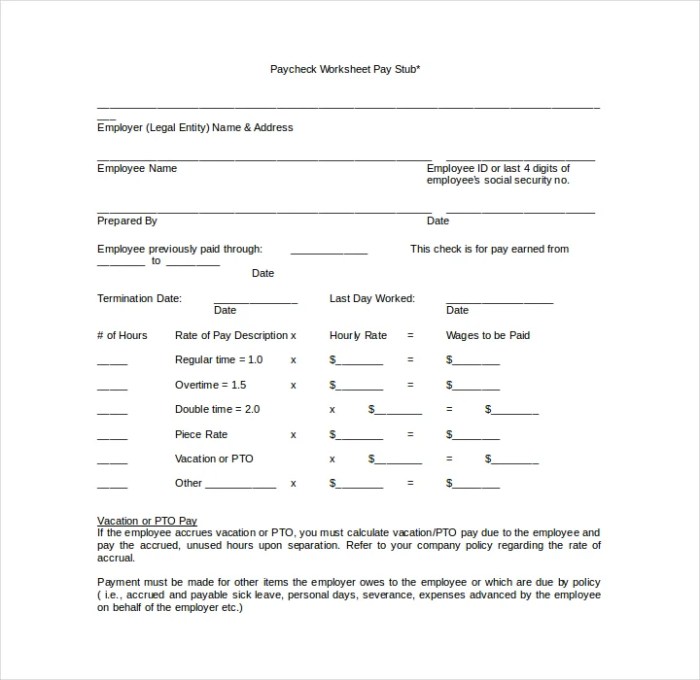

Paycheck Stub Basics

A paycheck stub is a document that provides a detailed breakdown of an employee’s earnings and deductions for a specific pay period. It serves as a record of the employee’s compensation and the taxes and other amounts withheld from their gross pay.

Key sections of a paycheck stub typically include:

- Employee information (name, address, etc.)

- Pay period dates

- Gross earnings

- Deductions

- Net pay

- Taxes withheld

- Other information (e.g., benefits, leave balances)

Gross Earnings

| Type | Description |

|---|---|

| Regular Pay | Earnings for hours worked at the employee’s regular rate of pay |

| Overtime Pay | Earnings for hours worked beyond the standard workweek at a higher rate of pay |

| Bonuses | Additional payments for meeting performance goals or other achievements |

| Commissions | Earnings based on sales or other performance metrics |

| Tips | Gratuities received from customers |

Gross earnings are calculated by adding up all types of earnings for the pay period.

Deductions

| Type | Purpose |

|---|---|

| Federal Income Tax | Withheld for federal income tax liability |

| Social Security Tax | Withheld for Social Security benefits |

| Medicare Tax | Withheld for Medicare benefits |

| State Income Tax | Withheld for state income tax liability (if applicable) |

| Health Insurance | Deducted for employee’s health insurance premiums |

| Retirement Contributions | Deducted for contributions to retirement accounts (e.g., 401(k)) |

Deductions are subtracted from gross earnings to arrive at net pay.

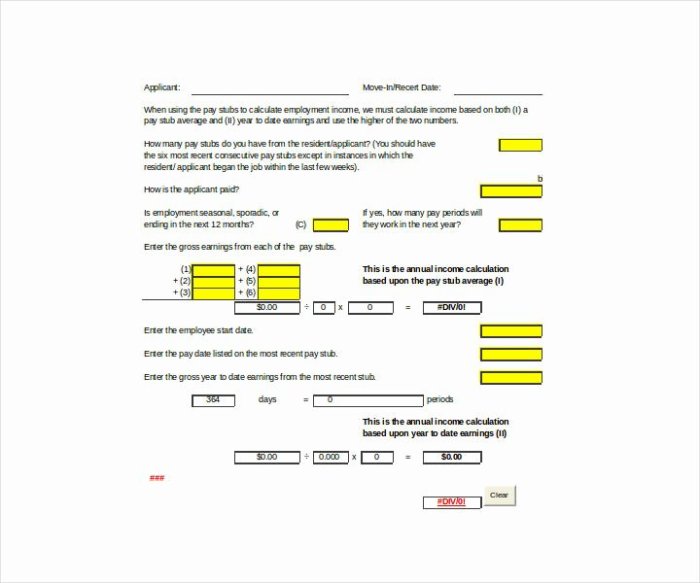

Net Pay: Reading A Paycheck Stub Worksheet Answers

Net pay is the amount of money an employee receives after all deductions have been taken out of their gross earnings. It is calculated using the following formula:

Net Pay = Gross Earnings

Deductions

Net pay is typically deposited directly into the employee’s bank account or issued as a physical check.

Taxes

Various types of taxes are withheld from an employee’s paycheck, including:

- Federal Income Tax

- Social Security Tax

- Medicare Tax

- State Income Tax (if applicable)

The amount of taxes withheld depends on factors such as the employee’s income, filing status, and number of dependents.

Other Information

In addition to the core sections, paycheck stubs often include other information, such as:

- Year-to-date earnings and deductions

- Leave balances (e.g., vacation, sick leave)

- Benefit information (e.g., health insurance coverage)

- Contact information for the payroll department or human resources

Understanding the information on a paycheck stub is important for employees to track their earnings, manage their finances, and ensure that their taxes are being withheld correctly.

Top FAQs

What is the purpose of a paycheck stub?

A paycheck stub provides a detailed record of an employee’s earnings, deductions, and net pay for a specific pay period.

How do I calculate my gross earnings?

Gross earnings are typically calculated by multiplying the number of hours worked by the hourly wage or salary.

What are the most common types of deductions?

Common types of deductions include federal and state income taxes, Social Security taxes, Medicare taxes, and employee benefits such as health insurance and retirement contributions.

How is net pay calculated?

Net pay is calculated by subtracting all deductions from gross earnings.

What information is typically found on a paycheck stub?

In addition to earnings, deductions, and net pay, a paycheck stub may also include information such as the employee’s name, address, pay date, and employer’s contact information.